The lazy narrative that people love to throw around is that retail is dead, and Amazon killed it. Of course, Amazon has completely changed the game (Amazon effect) changing shopping to always-on, always-open experience. Rest assured though, retail isn’t dead at all. Retail is evolving, and it is imperative that the shippers and their logistics partners who make up the retail supply chain keep up. To better understand this issue, Dr. C. John Langley Jr., (Clinical Professor of Supply Chain Management at Penn State University) and his team used the 2019 Third-Party Logistics Study (23rd annual) analyze these changing trends.

The lazy narrative that people love to throw around is that retail is dead, and Amazon killed it. Of course, Amazon has completely changed the game (Amazon effect) changing shopping to always-on, always-open experience. Rest assured though, retail isn’t dead at all. Retail is evolving, and it is imperative that the shippers and their logistics partners who make up the retail supply chain keep up. To better understand this issue, Dr. C. John Langley Jr., (Clinical Professor of Supply Chain Management at Penn State University) and his team used the 2019 Third-Party Logistics Study (23rd annual) analyze these changing trends.

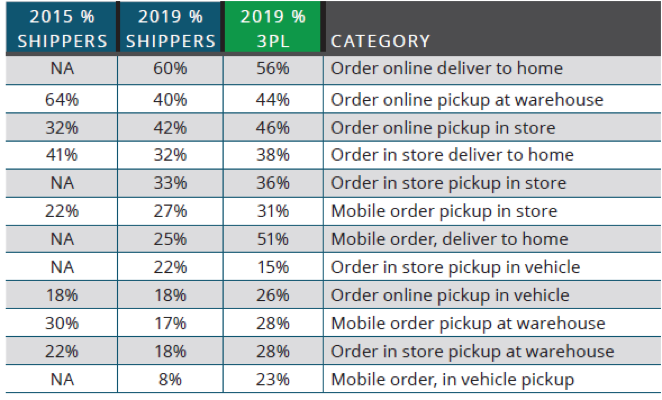

The name of the game for retailers in today’s environment is brand interaction. Customers feel a connection to their preferred brands and are demanding their favorite brands engage, grow, sell, inspire or delight them. As such, retailers must provide a unique customer experience around brands in order to get people in the stores. To that end, retailers must meet the demand of instant gratification by providing same-hour, same-day, or next-day delivery (see the innovative fulfillment options below)

Source: 3PL_2019_Study

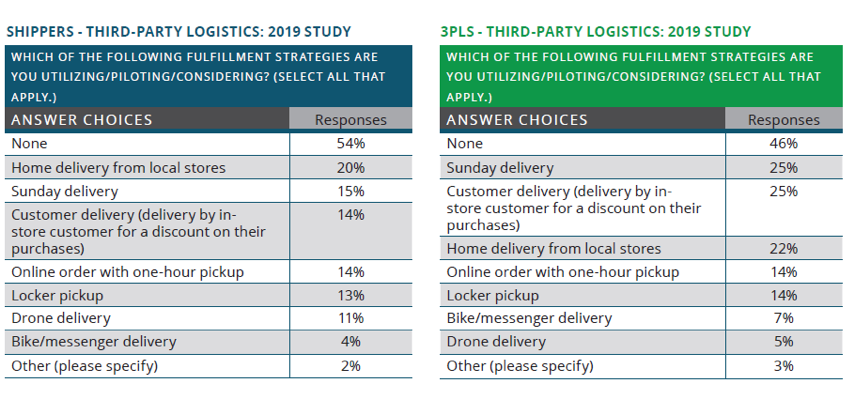

Now, brick and mortar stores must serve a new role as fulfillment centers allowing for pick-up of online orders and fulfilling local deliveries. though flexibility/last minute changes to orders remain a challenge within the supply chain shippers and logistics providers are trying various options to adjust (see below)

Source: 3PL_2019_Study

New investments in enterprise resource planning software (ERP), warehouse management systems (WMS), and transportation management systems (TMS) are improving communication between the supply chain, increasing efficiency, and cutting costs. Moreover, warehouses are taking a proactive advisory role in the supply chain while demand for warehouse space is increasing.

Many clothing retailers have adjusted well to the changing landscape. Ann Taylor Loft and Nordstrom allow customers to pick up mobile orders in stores. They’ve then been able to upsell the customers once they are in the store. The Gap has converted many stores to outlets giving customers better deals in store than online.

Penske Logistics analyzed he Amazon effect on the supply chain thusly, “With its always-on accessibility and two-day shipping, Amazon has dominated e-commerce while also impacting shippers’ decision making and driving change throughout the world of e-commerce and the supply chain in general. Today’s consumers have gotten used to rapid fulfillment, and now the same timeliness is expected in a business-to-business delivery. To enable faster deliveries, those within the supply chain are working to shorten lead times and provide more frequent, smaller deliveries. Instead of the truckload hub-and-spoke model, some providers are turning to less-than-truckload deliveries or zone skipping to speed the process. The move to LTL and zone skipping can cost the same or less than a truckload delivery based on the density and the amount of volume going to a specific geographic location. On the distribution side, the industry is seeing distribution centers and warehouses that are located closer to consumers and hold high-moving products. In some industries, creating an Amazon model for production can be difficult, as many supply chains weren’t set up to meet those kinds of demands. This is driving the need for greater communication and collaboration between shippers and their logistics partners as well as increased technology to provide visibility, optimize routes, improve slotting patterns and ensure goods remain in motion.” 3PL_2019_Study.

By strong engagement with customers as well as improved efficiencies in the supply chain, brick and mortar retailers will be able to not just survive, but thrive in a world dominated by e-commerce and Amazon.

Leave a Reply